[Use Case] Beyond Price Wars: How Grocery Delivery Services Are Missing Customer Trust (A 5-Hour Analysis)

Nov 25, 2024

Executive Summary

Price increases and inflation in groceries remain constant topics in the media. Using Brox.AI's quick query bar, we dove into existing qualitative data to explore price's role in grocery shopping - both in-store and delivery. Each query revealed new questions, instantly answerable without launching new research.

This use case demonstrates how our technology mines qualitative data for actionable insights in minutes, not weeks. No new surveys. No waiting for results. Just deeper insights from data you already have.

Through AI-powered analysis of existing consumer data, we uncovered:

Price drives store choice but fails to retain delivery customers

Walmart wins on value while delivery services struggle with trust

Same-shopper scheduling outperforms lower fees in driving adoption

The key insight? While everyone talks about price, trust determines delivery success. More importantly, we uncovered this complete story in a few hours - not the traditional 3-week timeline.

Essential reading for: Retailers seeking data-driven strategies to enhance value perception and attract new customers.

Background

Price increases and inflation in groceries remain constant topics in the media. We wanted to dive into the role of price in grocery shopping (including grocery delivery), uncover what brands may be doing a better or worse job and why, and brainstorm strategies brands may consider to provide relief for customers feeling the pain in their wallets.

The Speed Advantage: Instant Insights from Existing Data

Traditional grocery research requires new surveys for each question. With Brox.AI's ongoing grocery tracker dashboard and quick query bar, we transform weeks of waiting into minutes of discovery. Our qualitative analysis reveals patterns other methods miss.

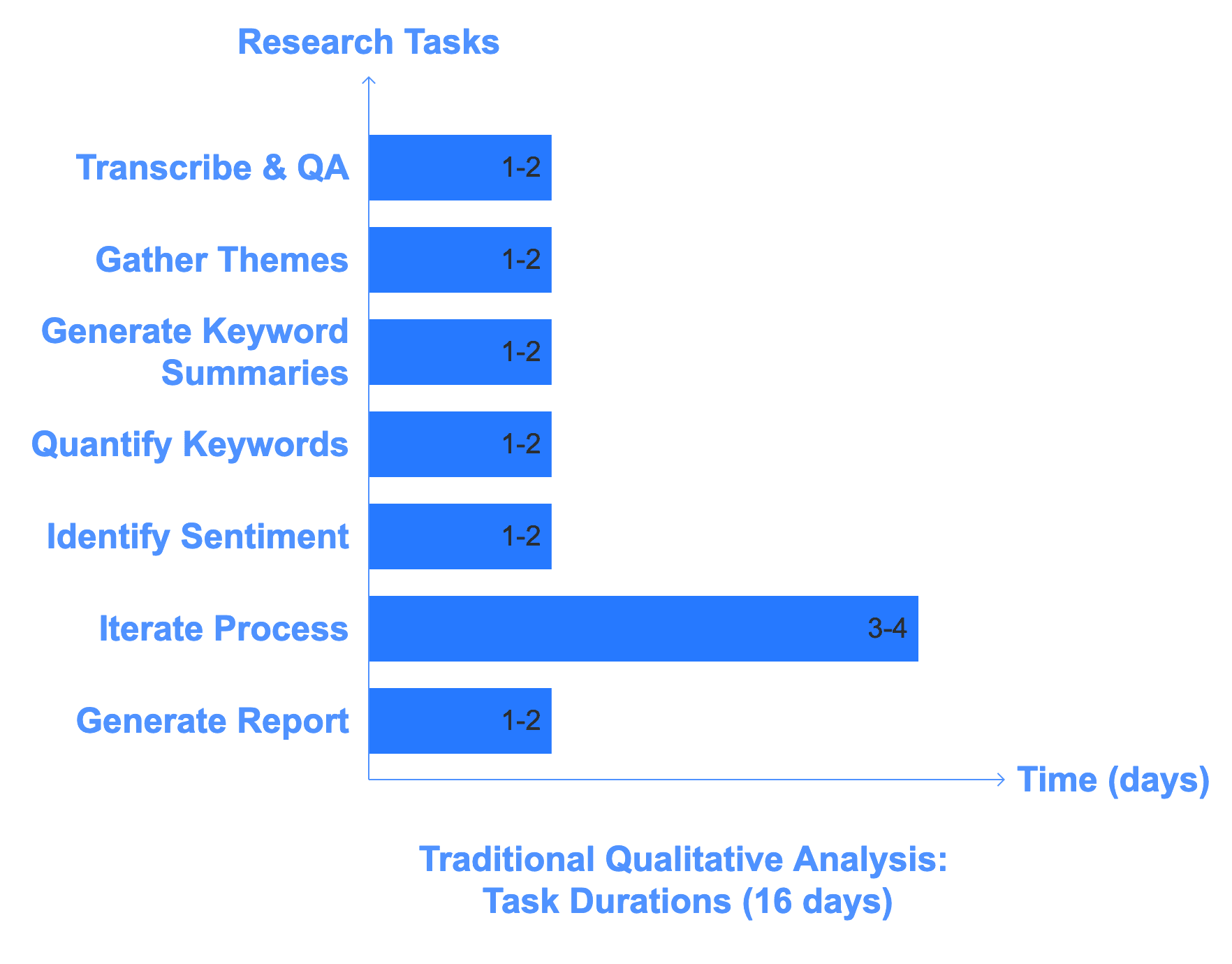

Images: Research Timeline Comparison charts

Step 1: Discovering Price's Dual Role

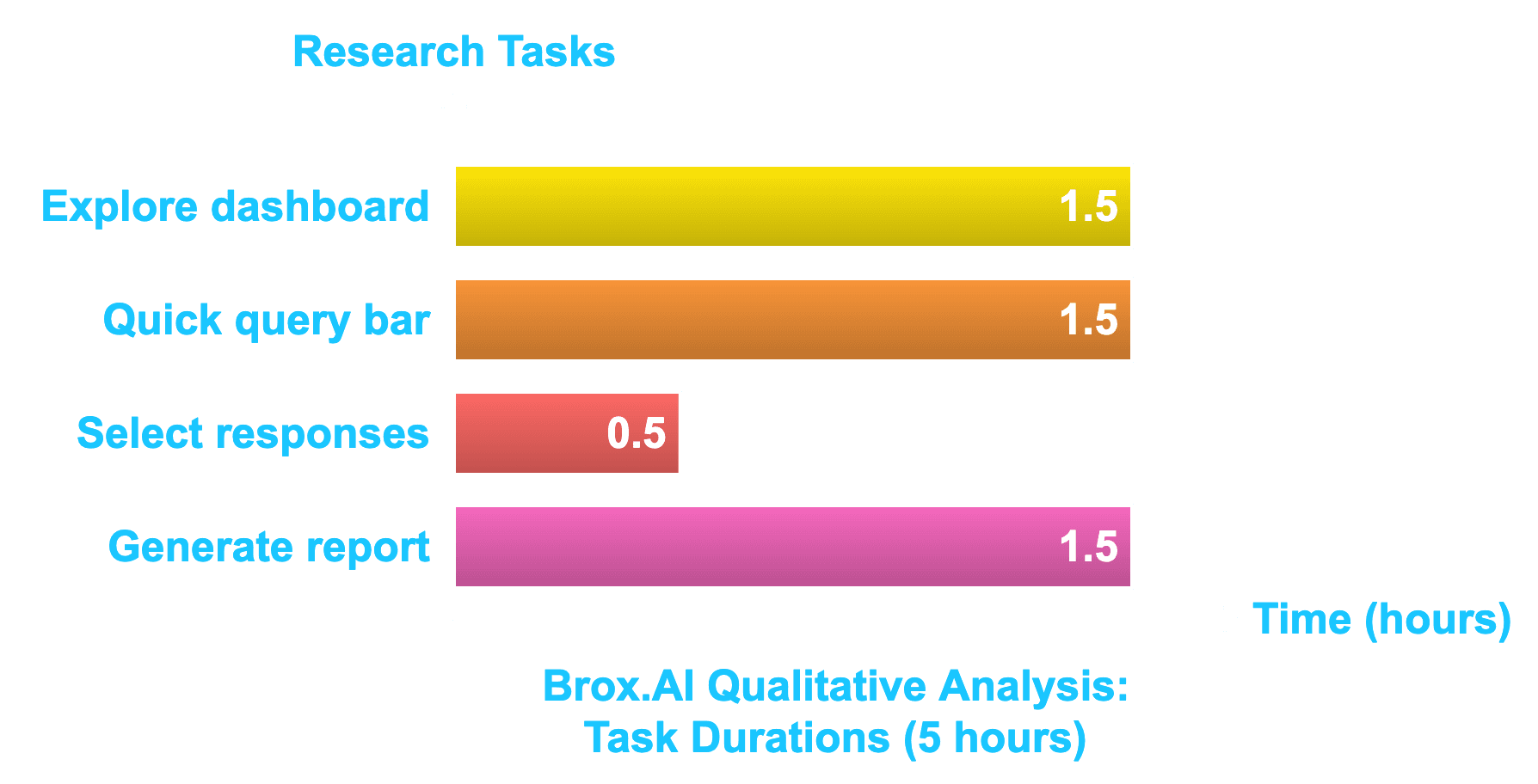

Our grocery tracking dashboard contains hundreds of fresh customer responses weekly. Within minutes, we spotted price's crucial role - both driving and deterring purchase decisions.

Image: Brox.AI Drivers & Pain Points

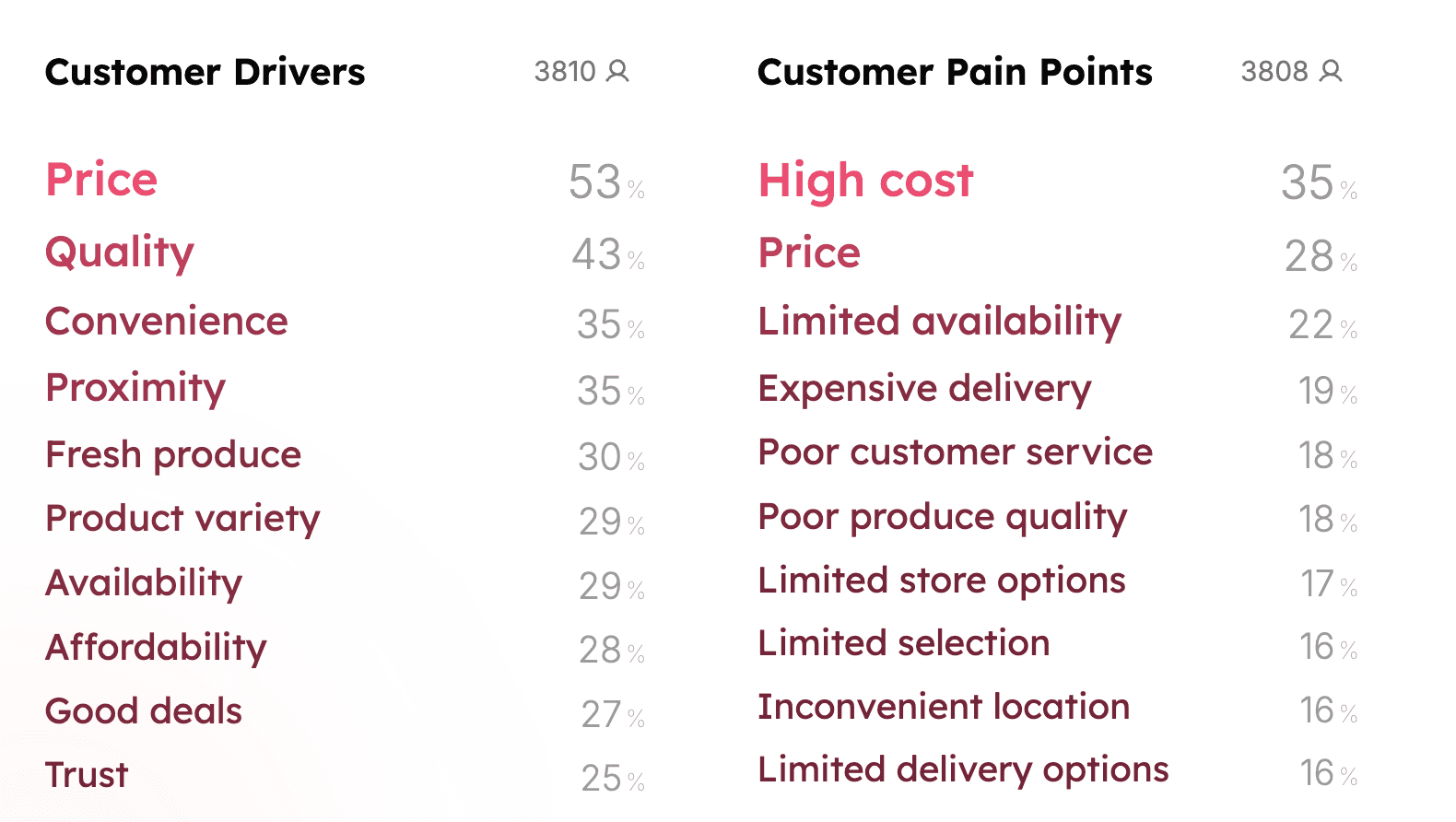

One click into "price" revealed clear demographic patterns. Age shapes price sensitivity dramatically.

Image: Brox.AI Gender & Age Breakdown

Watch how our quick query bar peels back another layer, revealing price's influence on both store selection and in-store brand choices:

Video: Brox.AI Quick Query Demo - Price Driver Analysis

High costs dominate customer pain points. Another quick query reveals why - inflation's impact on budgets:

Video: Brox.AI Quick Query Demo - Value Perception Analysis

Step 2: Beyond Initial Insights: The Walmart Paradox

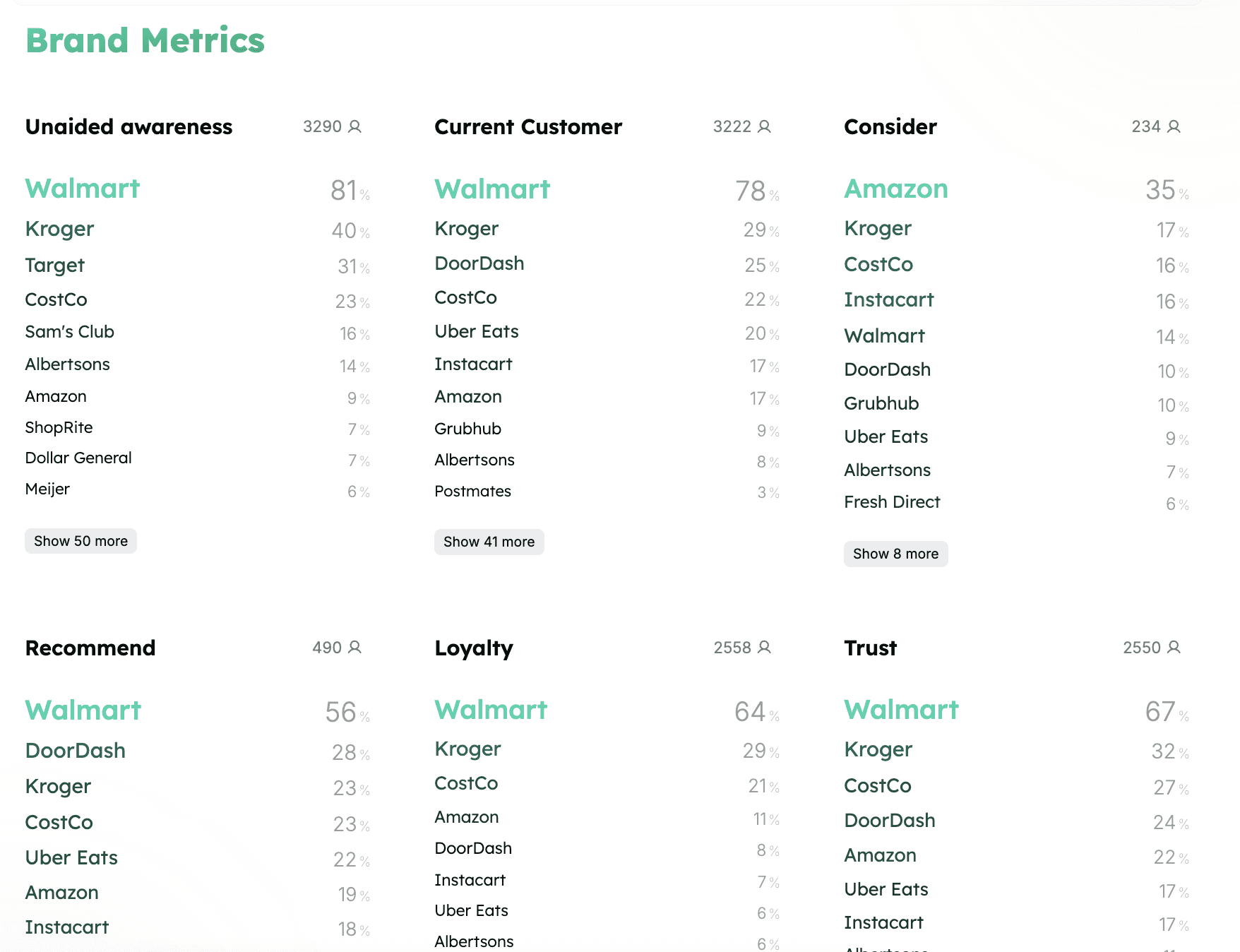

Without launching new research, we explored brand dynamics. Walmart leads in awareness, usage, loyalty, and trust. But why?

Image: Brox.AI Brand Metrics Visualization

Our quick query bar revealed Walmart's pricing advantage - value meets budget consciousness. Yet some consumers question quality. This tension sparked another question we could answer instantly.

Like peeling an onion's layers, each query revealed new patterns. Customers accept lower quality for staples and bulk items. But fresh produce? That's where the story gets interesting.

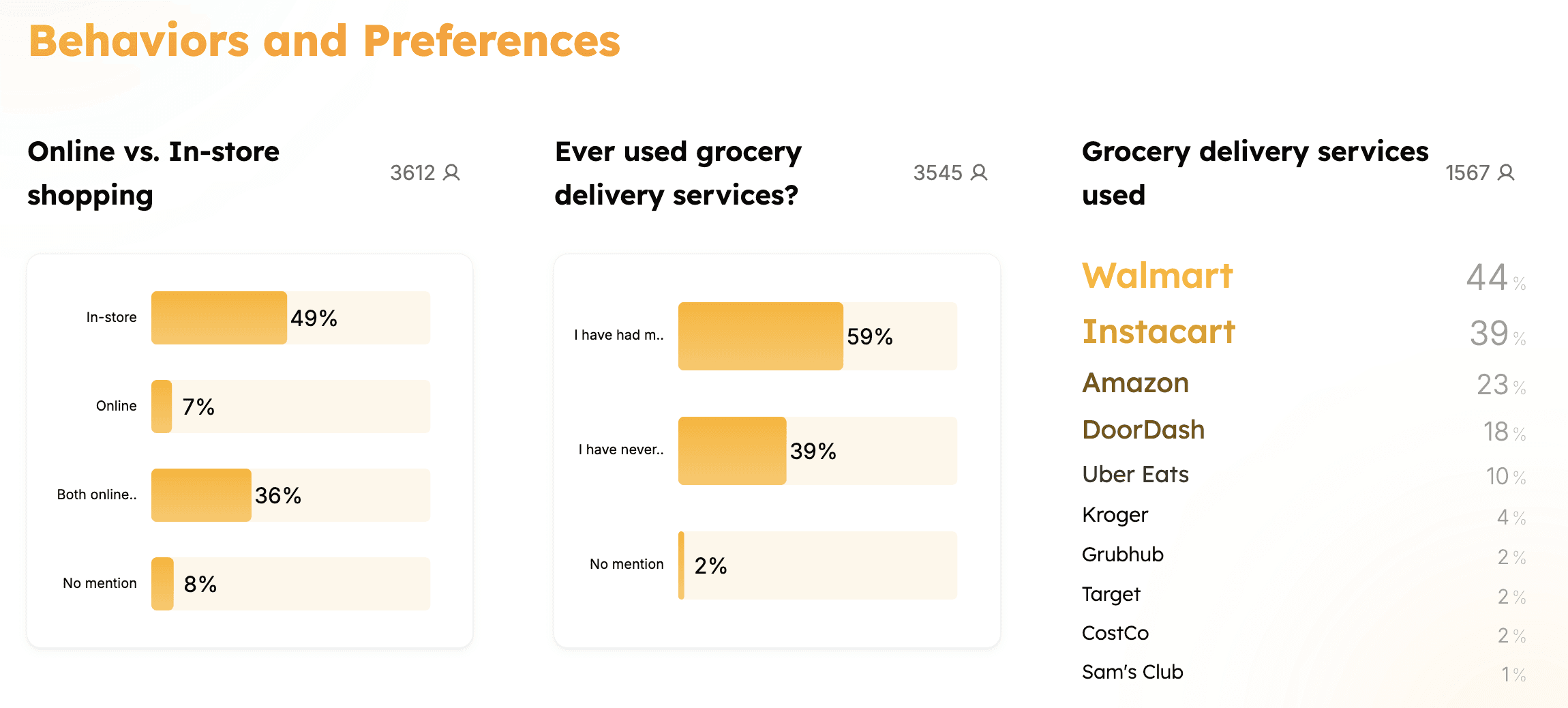

For delivery users - Walmart dominates, followed by Instacart, then Amazon and DoorDash. Yet only 40% ever order online. Our data explains why:

Image: Behaviors and preferences

Delivery services face a trust paradox. Higher prices but less control. Missing items. Poor substitutions. Each query deepened our understanding - no new research needed.

Step 3: Testing Solutions Through AI-Powered Analysis

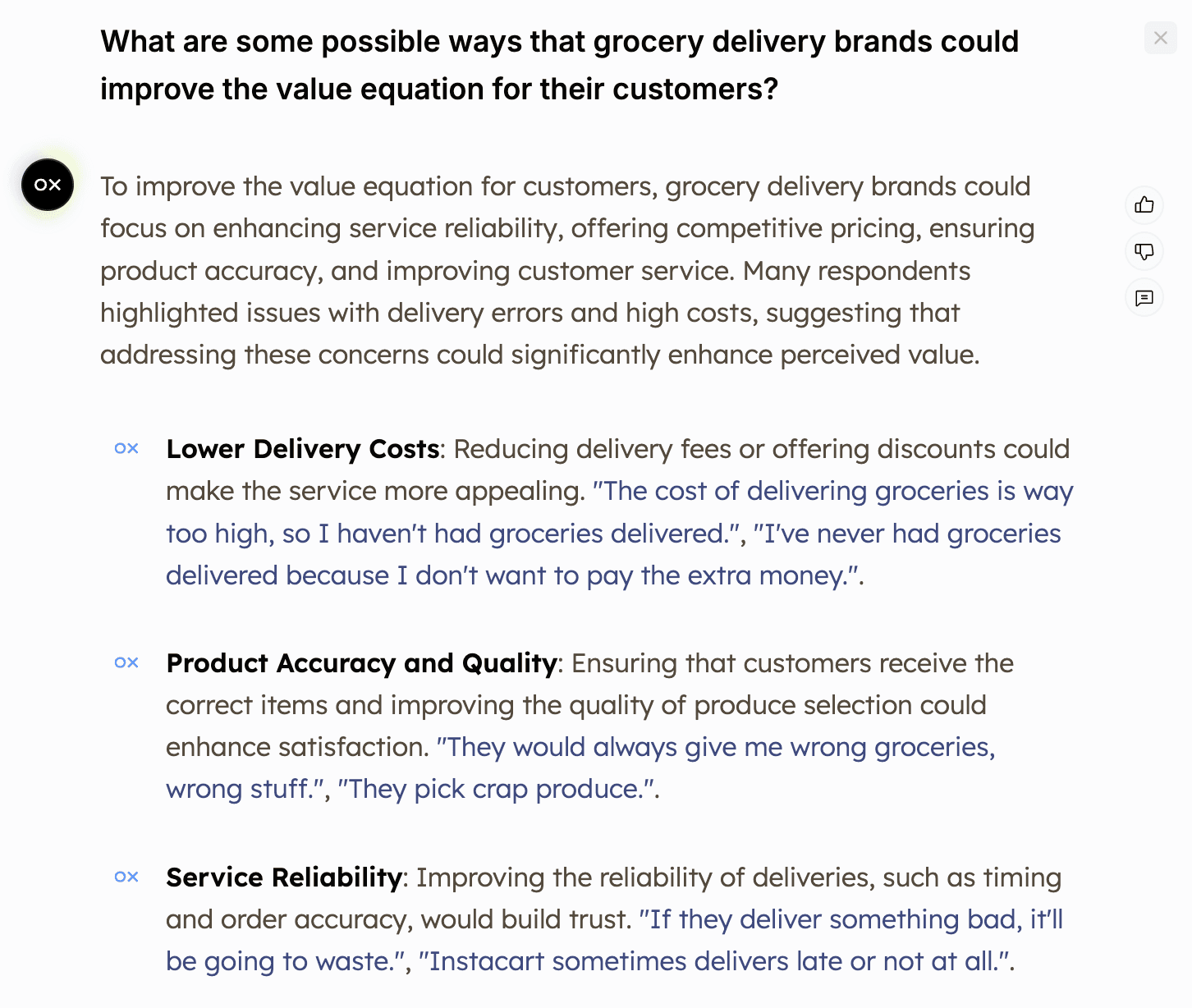

Could delivery services bridge this trust gap? Our quick query bar revealed potential solutions:

Image: Brox.AI Dashboard Insights

Step 4: The Shadow Panel: Deeper Insights Without New Surveys

Traditional research would stop here. New questions would mean new surveys. Instead, we turned to our Shadow Panel.

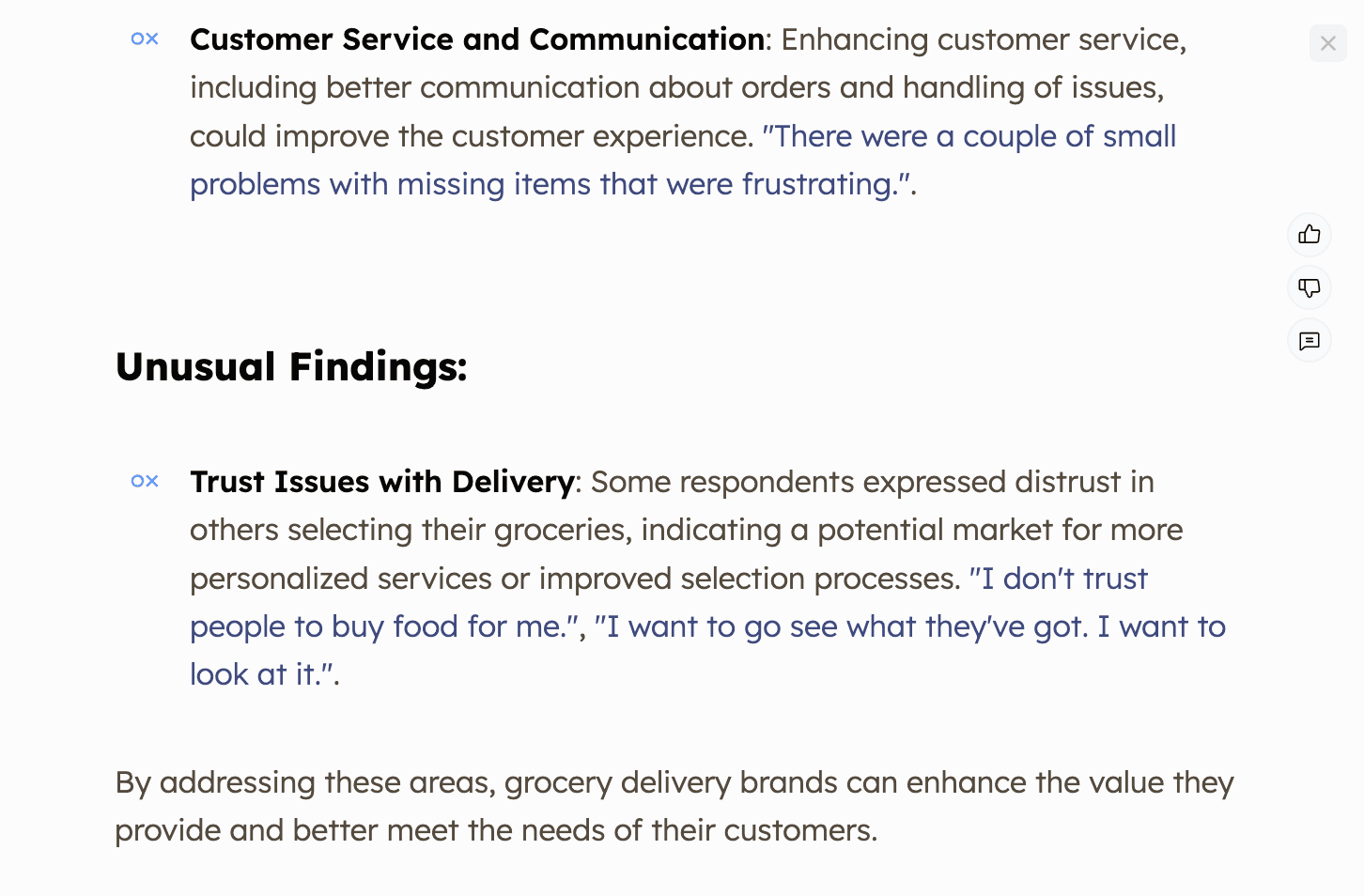

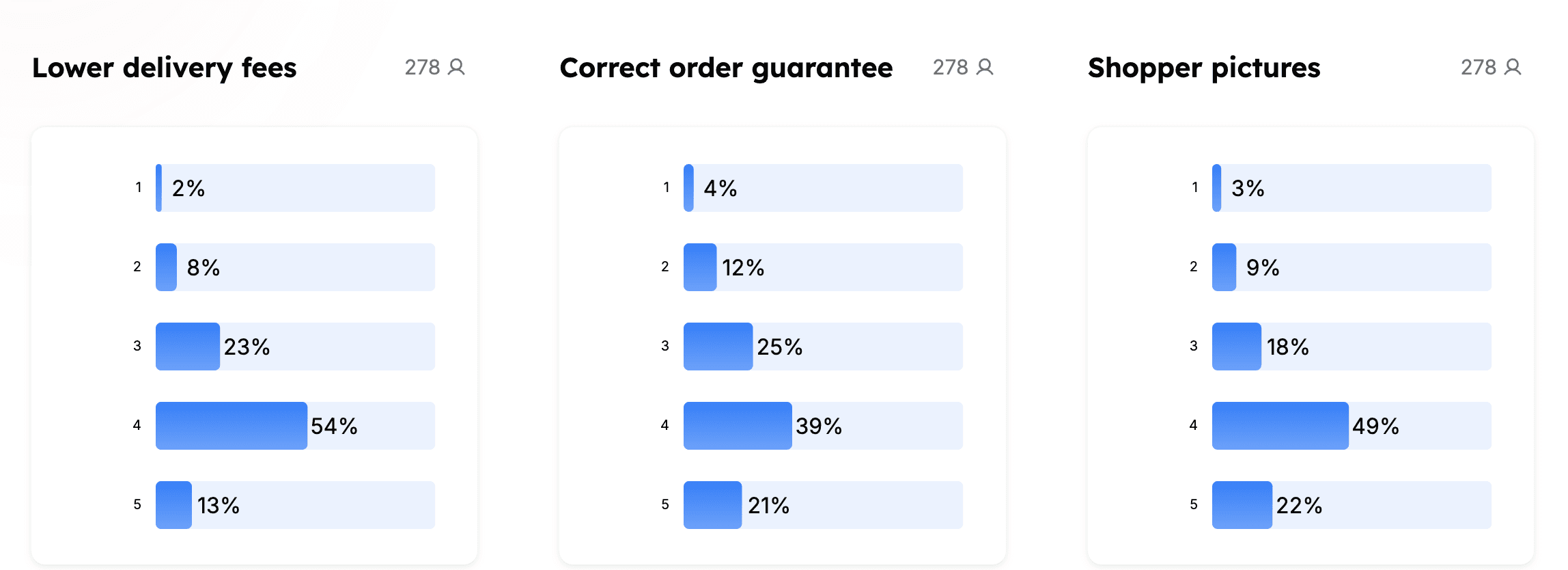

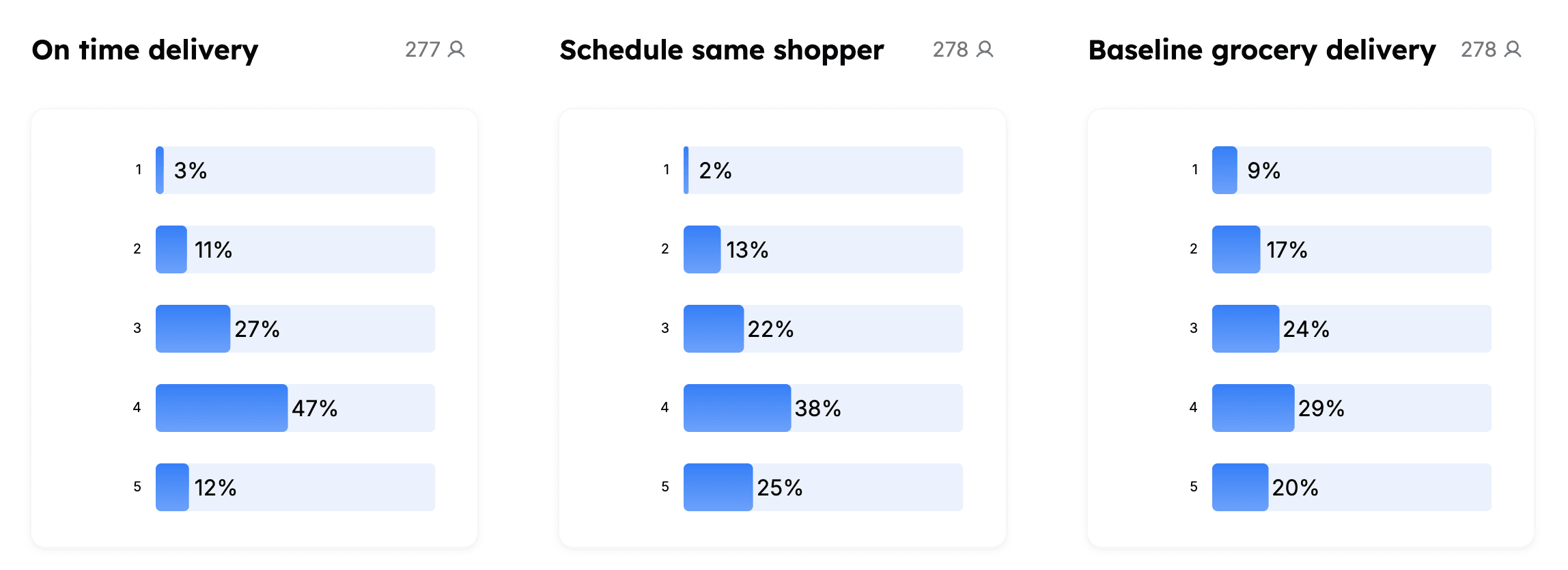

"How likely (1-5) would you try grocery delivery with these features?"

The results surprised us. Same-shopper scheduling beat price cuts. Photo verification drove trials.

Image: Brox.AI shadow panel response breakdown

Here's how our Shadow Panel predicts different consumer segments would respond:

Female 45-64: "While I appreciate the idea of having a shopper send me pictures of the produce to confirm quality and shelf-life, I still have some reservations about using a grocery delivery service. My past experiences with delivery services have been frustrating, especially when it comes to receiving the wrong items or produce that doesn't meet my expectations. I like to physically inspect fruits and vegetables to ensure they're fresh. Although this new feature would definitely improve my confidence in online ordering, I still prefer shopping in-store where I can see everything firsthand. So, on a scale from 1 to 5, I would say I am somewhat open but not fully convinced."

Female 18-29: "I would say I'm probably a 4. Having the option to schedule shopping and delivery with the same shopper sounds really appealing to me. It would definitely make the process smoother and more personal, especially since I have specific preferences when it comes to quality control—like making sure the produce is fresh. I still prefer shopping in person for certain items, but knowing I could have consistency with a delivery service would intrigue me. I appreciate convenience and good organization in my shopping experience, so this would definitely be a plus."

Male, 30-44: "I think I'd definitely be inclined to give it a shot if they offered a "100% correct order" guarantee. That sounds really appealing, especially since I've had a few issues in the past with orders not being quite what I expected. If I knew that everything I picked would actually arrive as expected, it would take a lot of stress out of the grocery shopping experience, and I wouldn't have to worry about getting the wrong items. I mean, it's frustrating when you don't get what you ordered, or if something is missing. So, on a scale of 1 to 5, I'd say I would be a solid 4 on trying a service with that kind of guarantee."

Female, 30-44: "While I can see the appeal of lower delivery fees, especially for someone like me who values consistency and familiarity in shopping, I've made it clear that I prefer in-store shopping and handling my groceries personally. A promotion like lower delivery fees might pique my interest initially, but I'm very particular about the condition of the items I purchase—especially perishables and baked goods that I trust myself to choose. So, I think I would be somewhat hesitant, but it's a nice perk to consider, especially if it would help me save a little money. Therefore, I'd say my likelihood to try this delivery option would be moderate."

These AI-generated responses, based on detailed consumer profiles, reveal nuanced perspectives without requiring new surveys. Each response reflects patterns from our extensive consumer data, helping us understand how different segments might react to new offerings.

Implications: Trust Beats Discounts

Lower delivery fees alone won't win. Success demands trust through quality and service.

The Speed Advantage: By the Numbers

Traditional analysis: 2-3 weeks Brox.

Brox.AI analysis: 5 hours

Real-time insight generation

Unlimited follow-up questions

Deeper qualitative understanding

Conclusion

Five hours. No new surveys. Deeper insights. That's the Brox.AI difference.

→ Download the PDF of this Use Case here

→ Listen to this as a podcast courtesy Google Notebook LM

Share on Social Media