[Use Case] US Bank Brand Health: How AI Revealed Customer Education as the Transformational Opportunity 2024

Oct 28, 2024

Listen to the Podcast version courtesy Google Notebook

The Question That Started It All

What drives brand health in banking? When Brox.AI set out to understand what people think, what matters, and why for US Bank, our AI analysis revealed something that would transform our understanding of the market.

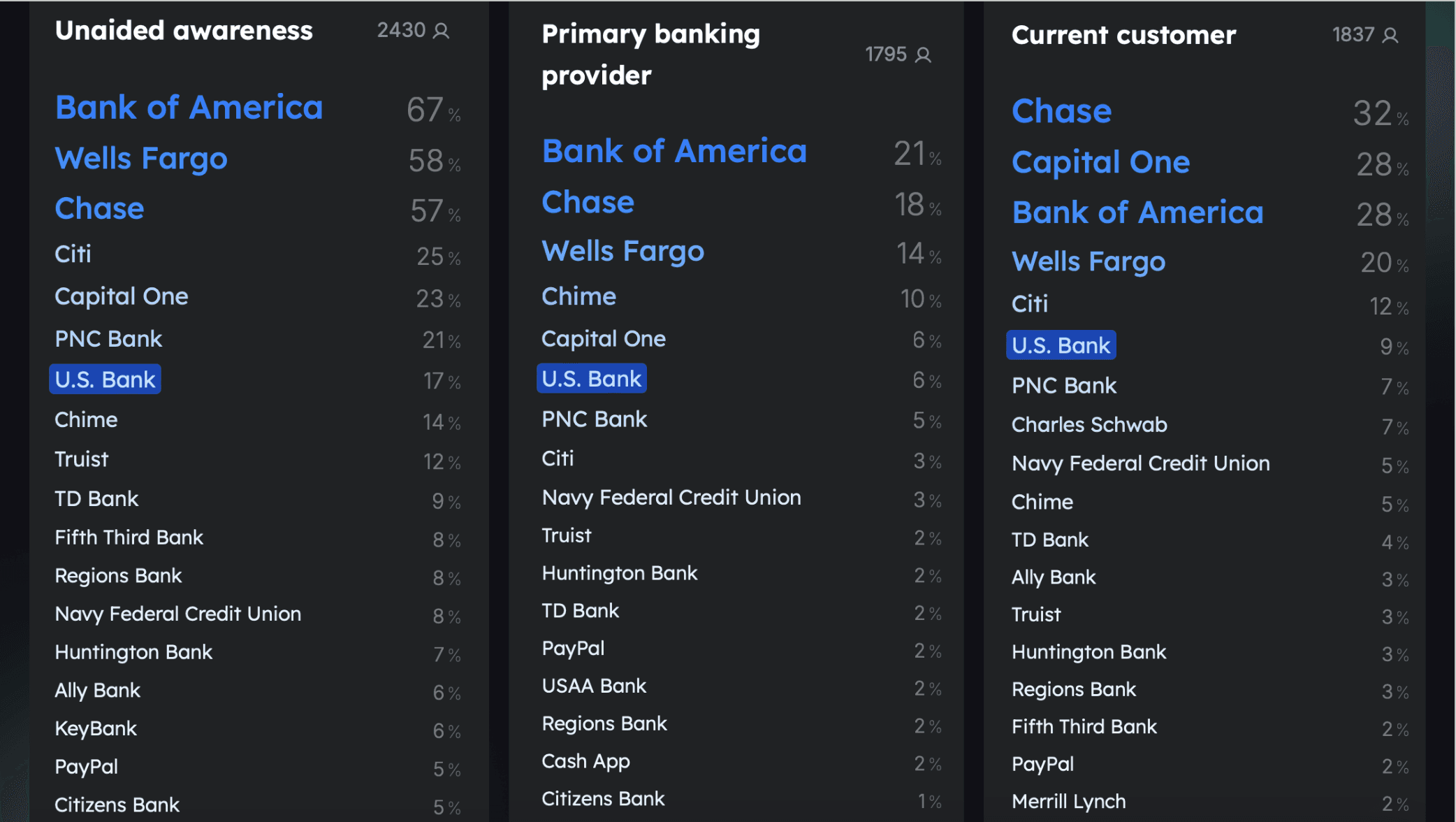

Current Brand Landscape

Initial analysis showed clear challenges:

17% unaided awareness (vs. Bank of America 67%, Wells Fargo 58%, Chase 57%)

6% primary banking provider share

5% positive buzz (vs. Capital One 40%, Chase 34%)

Yet within this data, our AI detected something promising. US Bank's positive buzz, though limited, centered on trust and service:

"They have a 24-hour fraud hotline. They were very good to her."

"US Bank is now offering CDs at a much higher rate."

"I like the ones for Chase Bank and US Bank the most."

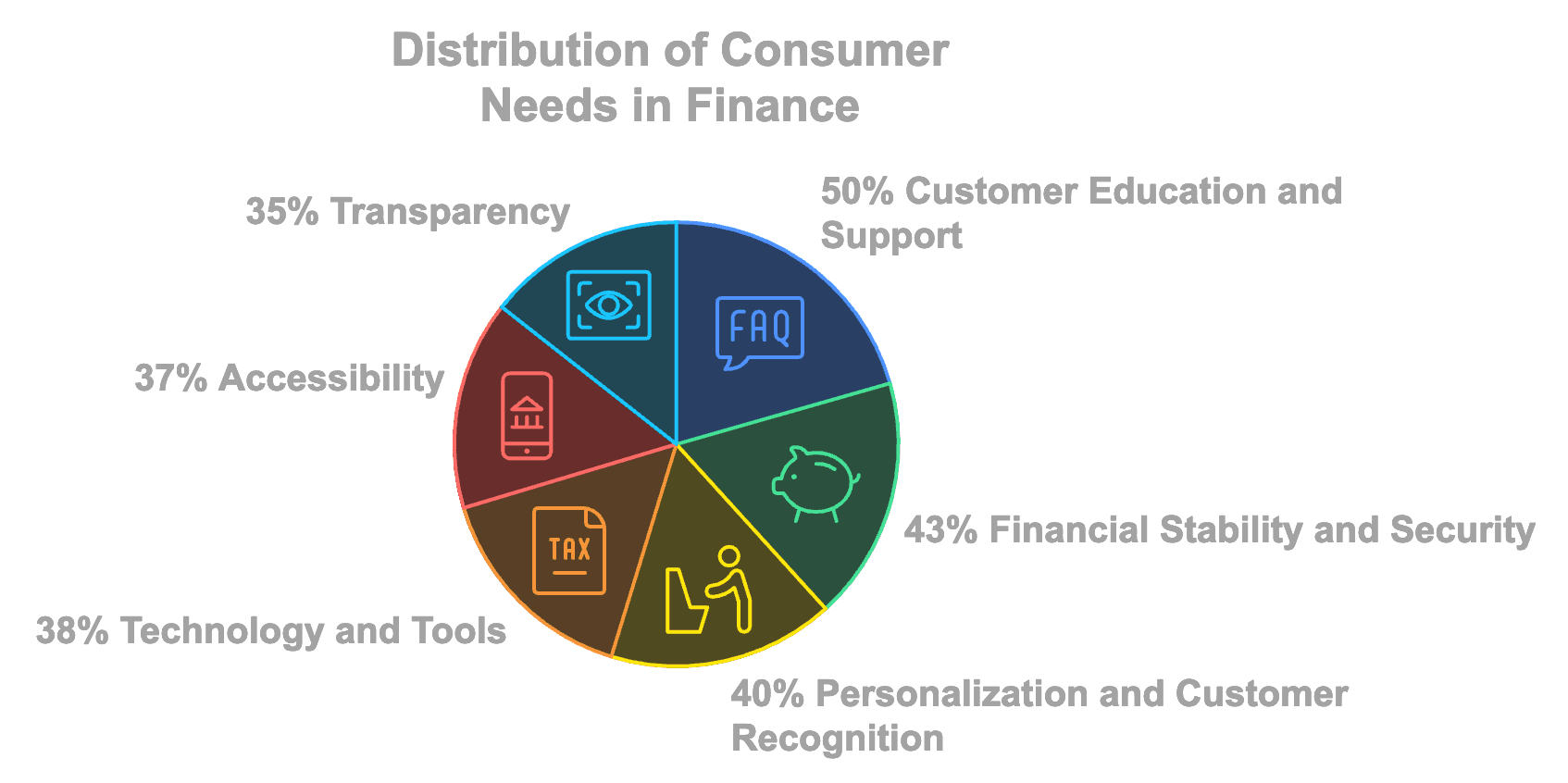

The AI's Breakthrough Discovery

Analyzing thousands of open-ended consumer responses, our AI made a striking discovery: customer education and support dominated all other needs in consumer finance:

Customer education and support: 50%

Financial stability and security: 43%

Personalization and customer recognition: 40%

Technology and tools: 38%

Accessibility: 37%

Transparency: 35%

This wasn't a minor trend. Education emerged as the top need across demographics:

Women: 52% prioritized education

Men: 47% cited it as crucial

Age breakdown showed consistent demand:

18-29 years: 43%

30-44 years: 45%

45-64 years: 53%

65+ years: 59%

The Critical Question

This discovery led us to ask: "What exactly do consumers mean by this and what kind of education and support do they want?"

Our AI analyzed thousands of qualitative responses, revealing three fundamental needs:

Trust and transparency in banking relationships

Practical financial management guidance

Clear understanding of products and services

AI-Generated Solutions

Based on this deep analysis of what consumers were telling us, our AI suggested four specific initiatives:

Free Online Workshop

AI Recommendation: Create a free online workshop focused on budgeting, saving, and investing

Consumer Voice: "My approach to finances and banking is very simple and flexible. It's all about being intentional and responsible with my money."

Financial Operations Education

AI Recommendation: Explain how financial institutions operate, including money management and account protection

Consumer Voice: "If I was going to use any bank, it would be Wells Fargo or Bank of America. They're nationwide and they're trusted by everybody."

Clear Product Information

AI Recommendation: Provide straightforward information about financial products, including benefits and drawbacks

Consumer Voice: "Recently, I signed up for a new credit card... because I wanted a reward program that aligns with my spending habits."

Security Education

AI Recommendation: Focus on security measures, fraud prevention, and authentication

Consumer Voice: "Bank America has a tool on their site that allows you to see how much you're spending."

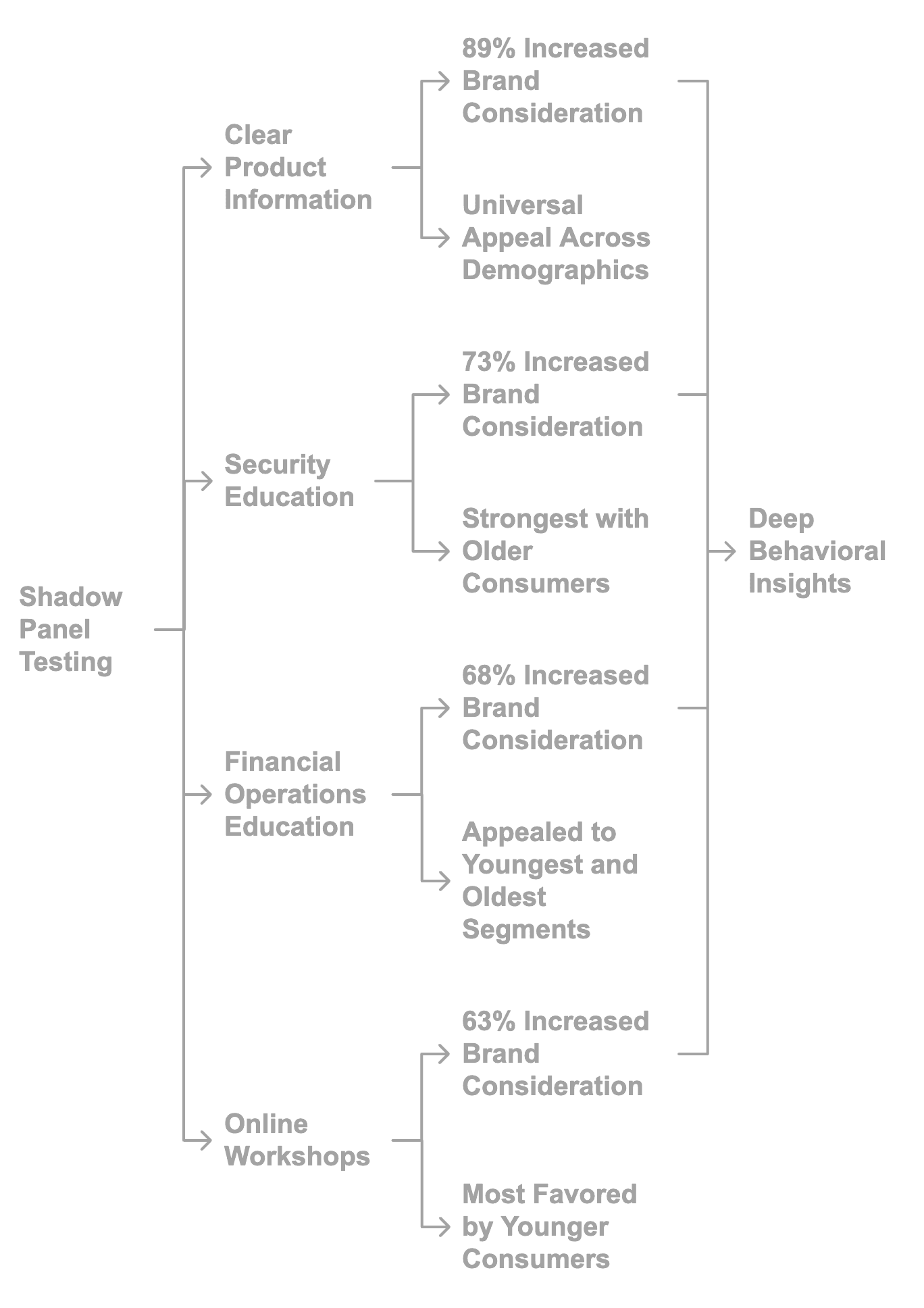

Shadow Panel Validation: Proving the Opportunity

To validate these AI-generated solutions, our shadow panel tested each initiative:

Clear Product Information

89% increased brand consideration

Universal appeal across demographics

Highest overall impact

Security Education

73% increased brand consideration

Strongest with older consumers

Clear trust-building potential

Financial Operations Education

68% increased brand consideration

Appealed to youngest and oldest segments

Lower interest from 45-64 age range

Online Workshops

63% increased brand consideration

Most favored by younger consumers

Slightly higher male preference

The shadow panel revealed deep behavioral insights:

"Given the respondent's profile, they exhibit characteristics of being cautious and value ethical behavior and responsible practices... The idea of an initiative to educate consumers about security measures and fraud prevention aligns with their cautious nature and appreciation for good customer service."

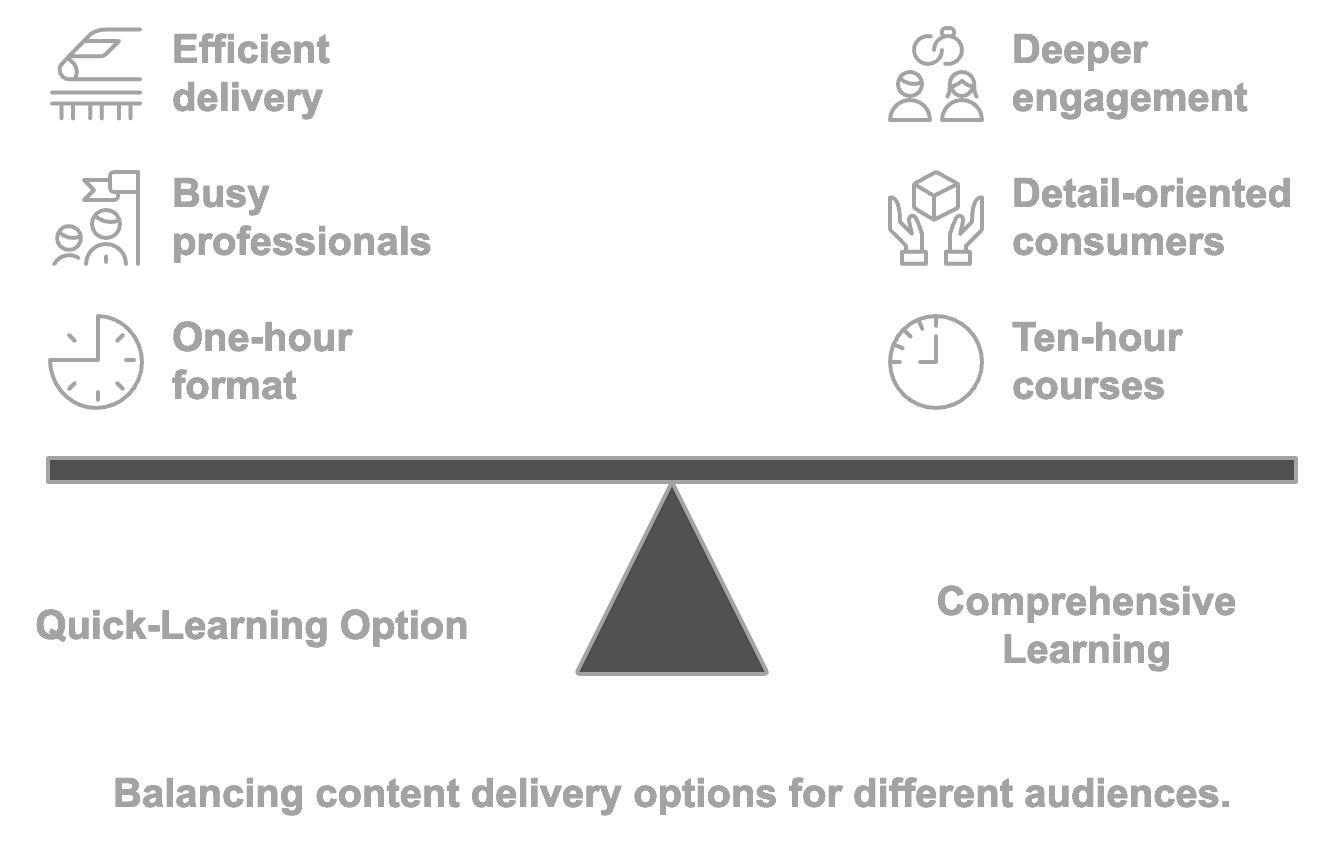

Optimizing Content Delivery

Our shadow panel uncovered two clear paths for maximum impact:

Quick-Learning Option

One-hour format most popular

Perfect for busy professionals

Efficient knowledge delivery

Comprehensive Learning

Significant interest in 10-hour courses

Appeals to detail-oriented consumers

Deeper engagement opportunity

Strategic Value

This analysis revealed:

Education as top consumer need

Clear path to addressing it

Validated solutions with high impact

Optimal implementation approach

Conclusion

What began as a brand health analysis led to a powerful discovery: customer education represents the greatest opportunity to transform US Bank's market position. Through AI analysis and shadow panel validation, we uncovered not just the opportunity, but the exact path to seizing it.

Download the full case study PDF for detailed findings and methodology.

Transform your brand health analysis with Brox.AI. Contact us for a demo.

Share on Social Media