[Use Case] Netflix Churn Prevention: Uncovering Insights to Retain At-Risk Subscribers

Sep 6, 2024

Brox It: To Retain "Churn Risk" Customers

It is easier to convince a customer to stay than to win them back.

The Streaming Churn Challenge

As customer cancellations across major streaming platforms continue to rise - 25% of subscribers have canceled at least 3 streaming services over the past 2 years, compared to 15% in 2021* - there is a growing interest in "win-back" customer segments. The problem? By the time a customer has left, it is difficult to find, target, understand, and persuade them to watch again.

For preventative strategies, we are interested in "Churn Risk" customers - those who are on the brink of leaving but haven't made their decision. With existing research tools and methods, these customers can be tough to monitor and retain. Frequently, formal study results come in too late to act on, and syndicated sources don't offer enough detail. Major streamers need a real-time and flexible solution to strategically put themselves between these Churn Risk customers and the door.

The Brox.AI Solution: A Three-Step Approach

Here is how we approached the elusive Churn Risk customer for Netflix, tapping into Brox's full suite of capabilities, including the Shadow Panel.

Step 1: Revealing Comprehensive Cancellation Reasons

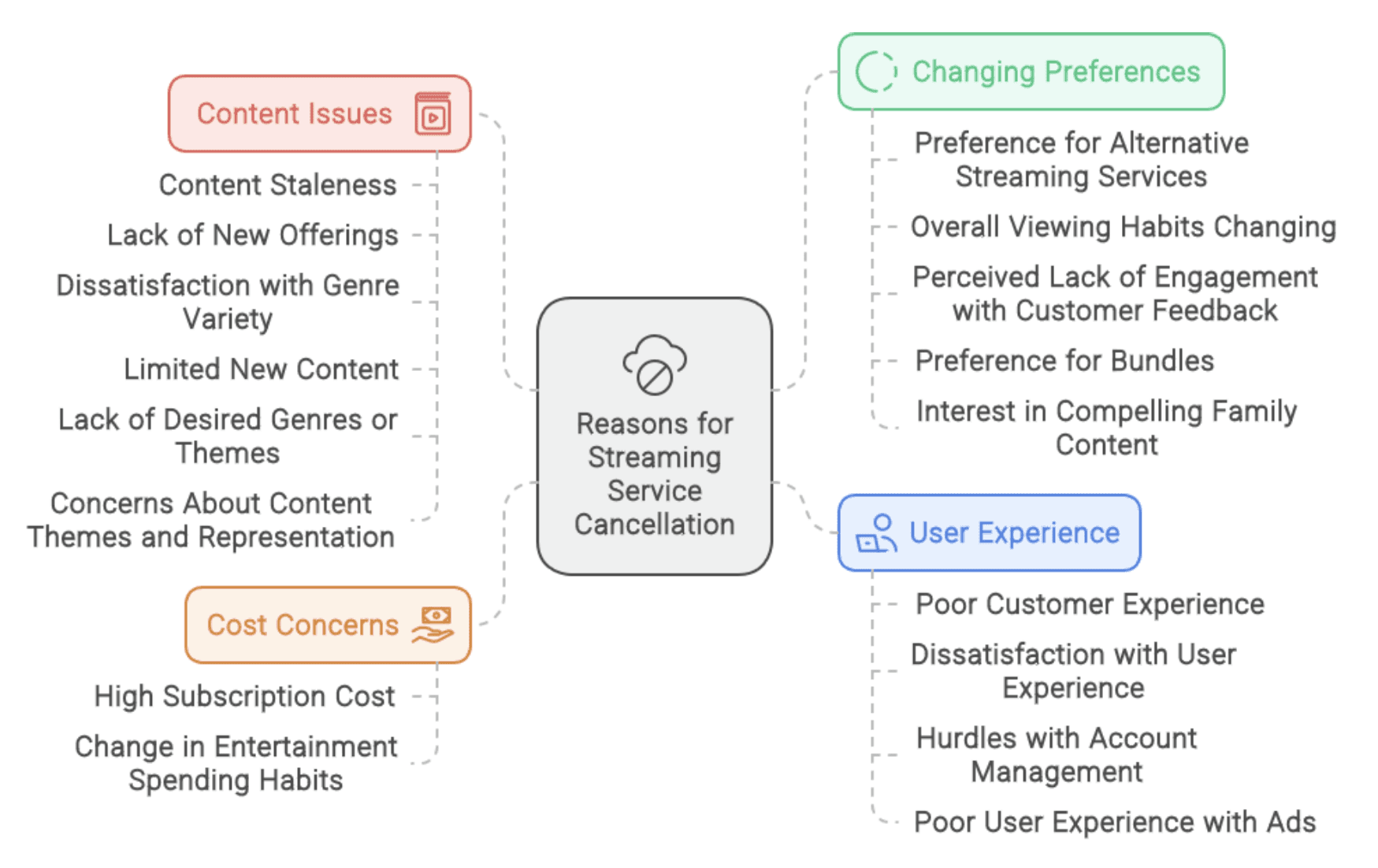

Brox analyzes over 10,000 customer responses to weekly open-ended questions on the streaming industry, including, "How does each streaming service fit with other entertainment in your life?" and "Tell us about the last time you canceled a streaming service." The analysis focused on customers who explicitly mentioned they were considering leaving Netflix. We curated a list of motivations, drivers, and circumstances driving cancellation consideration among customers.

Step 2: Identifying Pressing Cancellation Considerations

Analyzing a sub-segment of "Churn Risk" Netflix customers, we quantified the most frequently mentioned reasons for consideration. No singular reason made up more than 20% of responses, indicating that most Netflix subscribers have a variety of reasons they might be considering canceling. The most frequently mentioned cancellation considerations were: cost of subscription (17%), dissatisfaction with genre variety (12%), content staleness or lack of new offerings (11%), and change in entertainment spending habits (10%).

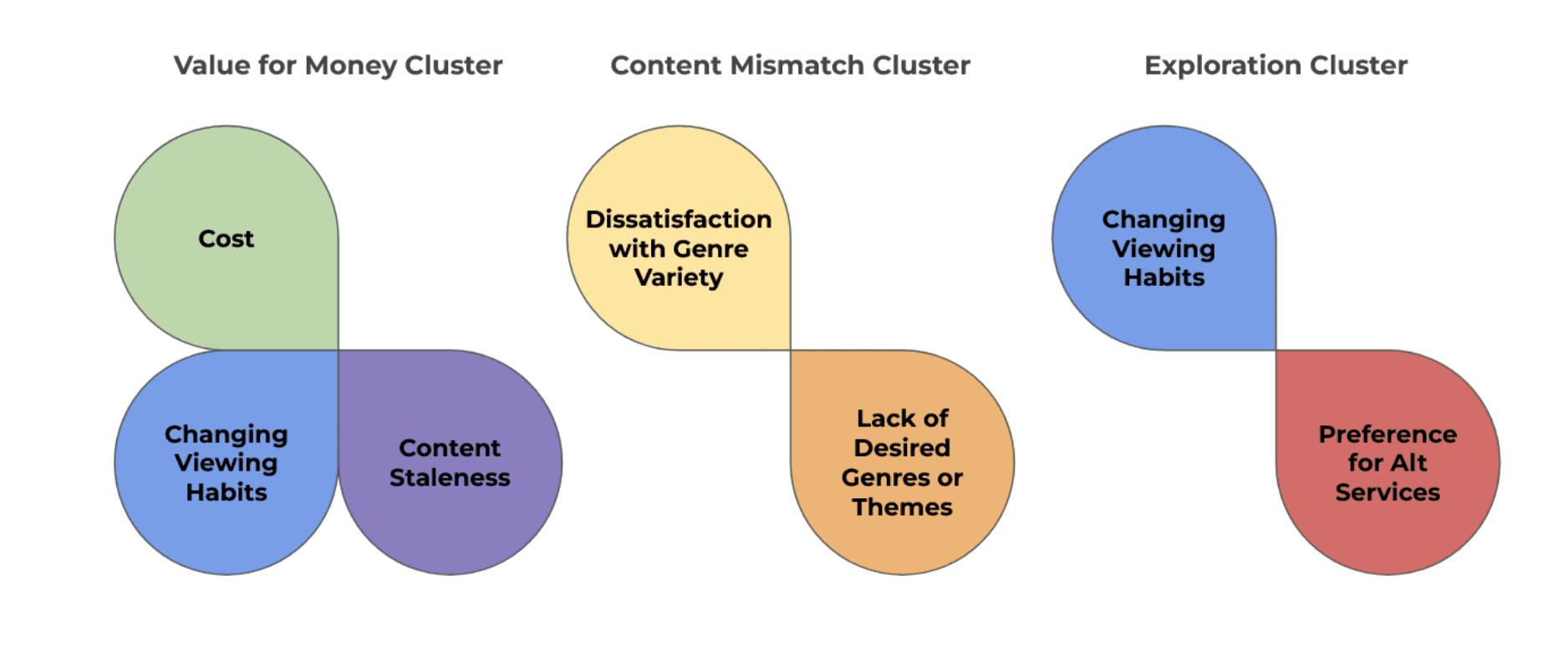

Since viewers frequently have multiple reasons they are considering canceling, we conducted a cluster analysis to understand which considerations frequently co-occur. This deeper dive revealed three significant motivation clusters:

"Value for Money Cluster"

"Content Mismatch Cluster"

"Exploration Cluster"

The Value for Money Cluster was one of the largest groups, suggesting that subscribers often feel they're not getting enough value for their money due to a lack of fresh content. As people's viewing patterns shift, they naturally reevaluate the cost-effectiveness of their subscriptions. The Content Mismatch Cluster represents viewers who do not feel their entertainment preferences are being met on the service. The Exploration Cluster indicates that as viewing habits change, subscribers are more likely to explore and switch to other streaming services.

Step 3: Leveraging Shadow Panelists for Specific Insights

There is further nuance we can elicit from the data. If customers are dissatisfied with genre variety, for instance, which genres are the most in-demand? Could customers articulate what makes the content feel stale?

For questions outside the scope of our weekly respondents, Brox offers the Shadow Panel. We can use the Shadow Panel to better understand how different cohorts would respond to unseen questions and understand differences in how individuals driven by different motivations, priorities, goals, and facing different challenges and external factors would respond.

We focused our efforts on "Content Issues" Churn Risk Shadow Panelists - those considering canceling Netflix due to reasons like content staleness, lack of new offerings, and genre variety. To better understand what specific genres or types of entertainment were driving their dissatisfaction, we asked our Shadow Panelists about content they'd like to see less of and content they'd like to see more of on Netflix specifically.

Dissatisfied Shadow Panelists reported feeling fatigued with the overwhelming presence of reality TV on the service, revealing a broader frustration with lack of originality and depth in content - "Netflix is so full of these reality shows and they're all the same thing." Shadow Panelists also mentioned they'd like to see less violent content and fewer horror movies, in both cases because customers are seeking more lighthearted viewing.

This desire for more "feel-good" entertainment comes through in the genres they want to see more of: documentaries, comedy, action/adventure films, and family-friendly content. Customers feel that documentaries in particular are underrepresented on streaming platforms. Their request for more comedies, adventures, and family entertainment stems from a desire for humor that provides an escape from reality, as current Netflix offerings are perceived to lean towards drama and reality TV.

The Future of Churn Prevention with Brox.AI

With Brox's capabilities, streaming platforms can stay connected with their Churn Risk customers and inject audience understanding into their retention strategies. Research teams have an agile, cost-efficient solution to answer real-time questions from business leaders. Growth strategy and retention teams can get customer feedback on proposed tactics through the Shadow Panel. Programming teams can benefit from content and genre deep dives. With updated video responses from customers on a weekly basis, Netflix teams have a flexible solution for timely questions.

Learn how Brox.AI can help your company tackle churn and boost customer retention: Contact us for a demo.

Citations: https://www.wsj.com/business/media/americans-are-canceling-more-of-their-streaming-services-fb9284c8

Share on Social Media